India Post Savings Account

Valid Active Single or Joint 'B' Savings account standing at CBS Sub Post Office or Head Post Office. Accounts standing at Branch Post Office are not eligible for availing Internet banking facility. Provide necessary KYC documents, if not already submitted. Government of India. The Regular Savings Account can be opened at the bank’s access points and your doorstep. This account can be used to keep funds secure, withdraw cash, deposit money and perform easy remittances, besides a host of other benefits. . Customer must have active Recurring Deposit account with Post Office. For the instant payment, you should have Recurring Deposit account number and customer ID. Loan Against Recurring Deposit. A customer who has a Recurring Deposit Account Post Office can easily avail loan against it. The India Post Payments Bank (IPPB) offers customers a facility to open savings accounts digitally using their IPPB mobile app. Post Office account holders can easily carry out basic banking transactions using their IPPB mobile app. IPPB Mobile App can be downloaded from the play store on Android phone or app store for iPhone.

Savings Account is the oldest and most common form of savings. The reason behind people preferring a savings account over any other form of savings is that here the principal amount is always safe no matter how much interest is earned. It can thus be said that the convenience of keeping the money in a savings bank account and earning interest is also the simplest form of investment.

Features & Benefits of Savings Account

Even though there are so many options to save money, the charm of Savings Account is still noticeable. Zero balance savings account has also got so much attention for its advantage of having the privileges of a savings account without maintaining any minimum balance in it. The features and benefits of Savings Account are as follows

- Safe and secure way to save money

- You can earn interest up to 8% per annum

- There is no minimum balance requirement for zero balance accounts

- Any Indian resident with valid ID proof can open this account

- There are no restrictions on how many bank accounts you can have

- You get ATM withdrawal option and Netbanking

- You can open a joint account with your family member

- Debit card issued can be used for payments

What is the minimum balance for a Savings Account?

The minimum balance required to maintain a savings bank account is subject to change from one bank to another just like the rate of interest. There are mainly two types of savings account - regular savings account and zero balance savings account. Banks have a certain minimum balance limit which an account holder has to maintain else he/she has to pay the penalty.

However, with the changes in other banking products, a savings account has also seen a major shift from being minimum balance account to zero balance savings account. Many banks now offer zero balance savings account due to increased demand as compared to the age-old pattern of keeping thousands in the bank account to avoid penalties. The savings account interest rate on these accounts are also high which makes it even more appealing.

List of All Banks Savings Account Interest Rates and Minimum Balance 2021

| List of Savings Account Banks | Minimum Balance Required(INR) | Savings Account Interest Rates (p.a.) | Features |

|---|---|---|---|

| Allahabad Bank | 1000 | 3.00% |

|

| Andhra Bank | 0/5//100/1000 | 3.00% |

|

| Axis Bank | 0/10000/25000/100000 | 3.50% - 4.85% |

|

| Bank of Baroda | 0/5/1000 | 2.75% - 3.00% |

|

| Bank of India | 500/5000/10000/20000/100000 | 3.00% - 3.25% |

|

| Bandhan Bank | 0/2000/5000/25000/100000 | 4.00% - 7.15% |

|

| Bank of Maharashtra | 1000 | 2.75% |

|

| Canara Bank | 500/1000 | 3.00% |

|

| Central Bank of India | 50 | 2.75% - 3.00% |

|

| Citibank | 200000 | 2.75% |

|

| Corporation Bank | 0/250/500/2500/15000/100000 | 3.00% |

|

| Dena Bank | 0 | 2.75% - 3.00% |

|

| Dhanlaxmi Bank | 0/5/1000/5000/10000/25000 | 3.50% |

|

| Digibank | 0 | 3.50% - 6.00% |

|

| Federal Bank | 0 | 2.25% - 3.65% |

|

| HDFC Bank | 2500/5000/10000/25000 | 3.00% - 3.50% |

|

| ICICI Bank | 0/1000/2000/2500/5000/10000 | 3.00% - 3.50% |

|

| IDBI Bank | 500/2500/5000 | 3.30% - 3.80% |

|

| IDFC Bank | 25000 | 6.00% - 7.00% |

|

| Indian Bank | 250/500/1000 | 3.00% |

|

| Indian Overseas Bank | 500-1000 | 3.25% - 3.50% |

|

| IndusInd Bank | 0/10000/25000/2500000 | 4.00% - 6.00% |

|

| Jammu & Kashmir Bank | 0/500/1000 | 3.00% |

|

| Karnataka Bank | 0/500/1000/2000 | 3.00% - 5.00% |

|

| Kotak Mahindra Bank | 0/2000/3000/5000/10000/20000 | Upto 4.00% |

|

| Lakshmi Vilas Bank | 1000/3000/5000 | 3.25% - 6.00% |

|

| Oriental Bank of Commerce | 0/500/1000 | 3.50% - 3.75% |

|

| Punjab National Bank | 500/1000/2000/50000 | 3.50% - 3.75% |

|

| Punjab and Sind Bank | 500/1000 | 3.10% - 3.50% |

|

| South Indian Bank | 0/2500/5000 | 2.35% - 5.00% |

|

| State Bank of India | 0/1000/2000/25000 | 2.70% |

|

| Syndicate Bank | 0/100/500/1000 | 3.00% |

|

| UCO Bank | 0/100/250/500/1000/1500 | 2.50% - 2.75% |

|

| Union Bank of India | 0/20/100/250/500/1000 | 3.00% |

|

| United Bank of India | 0/50/100/500 | 3.50% - 3.75% |

|

| Vijaya Bank | 500/1000/2000 | 2.75% - 3.00% |

|

| YES Bank | 0 | Upto 6.00% |

|

How to Open a new Savings Account Online

The procedure for online savings account opening with zero balance is very simple through Wishfin. The portal allows paperless process with no upfront verification. There is instant approval facility available which makes account opening process the easiest thing ever. The details required to apply for online savings account are as follows:

- Full name

- Mobile number

- Email ID

- City

Once the above details are provided, the applicants can compare different banks offering a savings account with zero balance and then apply for the bank as per the choice. The complete process just takes a few minutes.

Savings Account Interest Calculator

Savings Account interest calculator can be used to calculate the estimated investment growth over time. It helps you set a goal and then save money accordingly. The calculation can be done by mentioning the annual interest, invested amount and time period. For a shorter time period, you need to invest more money and vice versa.

Difference between Savings and Current Account

Savings account and current account have some similarities as well as some differences. A current account, on one hand, is one of the important things to have for businessmen as it allows a higher number of transactions on a regular basis as compared to the savings account. There is no interest provided by a current account by most of the banks but the overdraft facility can be availed easily. The minimum account balance (MAB) required on a current account is also very high as compared to the savings account. For better understanding, have a look at some of the basic difference between savings and current account.

| Features | Savings Account | Current Account |

|---|---|---|

| Type of Account | Deposit Account | Daily Transactions |

| Minimum Account Balance (MAB) | 0 | Minimum INR 10,000 |

| Interest Rate | Up to 7% | NIL |

| Free Transactions Allowed | Limited | Unlimited |

| Overdraft Facility | No | Yes |

Thus, savings account, especially online savings account, is suitable for anyone who wants to earn interest on their deposits. Current account, on the other hand, is preferred by the individuals and firms who require monetary transactions on a day-to-day basis. Also, the highest savings account interest rate can be earned on a zero balance account and not on a regular bank account.

FAQs

Below are some of the queries frequently asked about a savings account.

How to check your Savings Account balance?

You can check your Savings Account balance through ATM, NetBanking, SMS and Passbook.

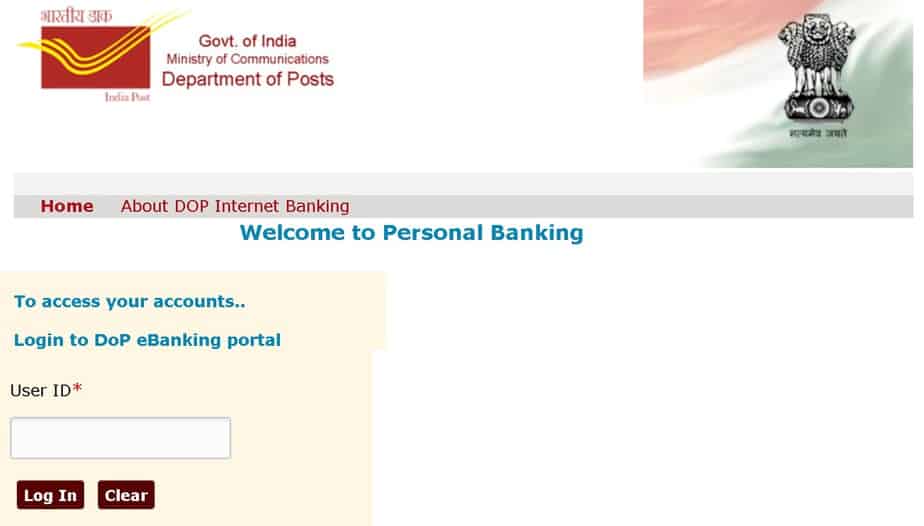

DoP Internet Banking - Post Office Internet Banking

India Post also facilitates internet banking service through DoP internet banking. You can check your account balance or for any other banking services, you can login through its internet banking portal with the help of a username and password.

Tax Exemption on Savings Account

Under Income Tax Act 80TTA, interest up to INR 10,000 is exempt from tax. For senior citizens, the tax exemption on a savings account interest rate is up to INR 50,000 under Income Tax Act 80TTB.

Now PPF account holders can deposit money online through India Post Payment Bank (IPPB) application.

In this coronavirus time or otherwise one can deposit money online in the PPF account.

Public Provident Fund is one of the most popular tax-saving instruments in India. PPF is a 15-year scheme backed by the Central Government of India.

It is a completely safe and secured scheme which is backed by the Government of India.

- Firstly you have to deposit money from your bank account to your IPPB account.

- Go to the DOP service.

- Choose the product in which you want to deposit the money like a recurring deposit, PPF account, loan against recurring deposit or other.

- Enter your PPF account number and DOP customer ID.

- Mention the amount that needs to be deposited and click on pay option tab.

- the IPPB will notify you for successful payment transfer made through the mobile application.

- You can opt for various post office investment options provided by India post and make payment through IPPB basic saving account.

How to register for IPPB mobile App

For New Clients

Open your digital savings account by following on-screen instructions.

After downloading the app, you have to give your mobile number and PAN card number.

Once you click submit it will generate an OTP.

Submit the OTP.

It will aks for AAdhar card number or otherwise you can scan QR code on Aadhard card.

Again you will get OTP. Submit the OTP and follow the on screen instructions and you will be able to open your account.

For existing customers

STEP 1 Enter the details:

India Post Savings Account Form

- Account number,

- Customer ID (CIF) and DOB

- registered mobile number

2)You will receive a one-time-password (OTP) on your registered mobile number

3) Set MPIN

4) Enter the OTP

India Post Savings Account App

You are ready to make any number of transactions you like.

Additional resources :https://www.youtube.com/watch?v=HK_vgGQQTzw

India Post Savings Account Ifsc Code

Currently available services on Mobile Banking:

National Savings Account Post Office

- Account balance enquiry

- Request for a statement of your account

- Request for a cheque book (Current Account)

- Stop payment on a cheque

- Transfer funds within the bank

- Transfer funds to other bank accounts

- Pay water, electricity and utility bills

- Recharge prepaid and DTH (direct-to-home) services

- Manage your funds with the linked POSA (Post Office Savings Account) by using Sweep-in and Sweep-out facility