Free Checking Account No Credit Check No Deposit

A bank account is one of those required things in life. You need access to a debit card for purchases or direct deposit from an employer. A bank account is almost the only way to enjoy these basic services. But if you’ve experienced financial challenges or unexpected events — and the ensuing bad credit — it may be difficult to open a new bank account.

That’s right, there are no monthly service fees, no minimum balance requirements, unlimited check writing and no fees on checks/debits that clear. As if that wasn’t enough, with our free checking account, you have unlimited access to your funds using the Natco Credit. There are no fees to open, keep or use your Capital One 360 Checking account, or for foreign transactions. But let’s be totally upfront here: There may be some things you want or need to do with your account.

The good news is that you can still open a free online bank account with no credit check, no monthly fees, or minimum balance requirements. CheckingExpert has helped thousands of people just like you open online bank accounts. No credit check bank accounts that give you all the checking account features you need and deserve without the exorbitant fees many banks impose.

Credit Bureaus, ChexSystems, and Bank Accounts for Bad Credit

Most banks look at the credit history of their customers before granting them the ability to open a checking account. Some banks run a credit check through one of the major credit bureaus: TransUnion, Experian, or Equifax.

Other banks will dig deeper by turning to a company called ChexSystems. This company identifies your history with overdrafts, bad checks, and account freezes. Additionally, banks will look at check fraud, negative balances, and excessive withdrawals through Early Warning Systems (EWS). If you find yourself blacklisted by one of these companies, getting a bank account can seem impossible.

Getting A Bank When You Have Bad Credit

The researchers at CheckingExpert.com have selected the top two banks where you can get a bad credit bank account. There are no hidden fees, no minimum balance, and no monthly fees. You can apply online and it takes only a matter of minutes to complete the application process. If you’ve got bad credit and need a checking account, these banks are two very strong options.

Winners: Best Banks For Those With Bad Credit

The BBVA Online Checking Account is our favorite second chance bank account. They have the strongest offering of any of our recommendations. No hidden fees, no monthly minimums, and no monthly service charge. It’s easy to get approved and takes about 3 minutes. Plus, their smartphone app and online tools are the best we’ve reviewed.Why do we recommend BBVA Online Checking so highly? If you’ve got poor credit or find yourself on ChexSystems, BBVA will approve you for an account.

- NO monthly service charge

- NO monthly account balance minimums

- NO fees at over 64,000 Allpoint® and BBVA ATMs worldwide

- FREE award-winning mobile app (one of the best we’ve reviewed)

- FREE Visa® debit card you can personalize with your favorite photo

- FREE online banking, bill pay, and mobile deposits

- FREE money transfer to and from any email or mobile phone in the U.S. via Popmoney®, Venmo®, and other instant transfer services

- FREE dedicated team of mobile bankers you can contact via text, email, or phone

- FREE cash back rewards for everyday debit card purchases with Simple CashBack

- FREE unlimited check writing

- FREE Visa Zero Liability protects you against fraudulent purchases made on your debit card

- BBVA USA, member FDIC

You can get an account today! The BBVA website is simple and easy to interact with. There is a $25 minimum deposit required to open an account and once that deposit clears, you’ll be off and running. Hands down, BBVA is one of the most friendly banks for those who have been negatively impacted by ChexSystems. The entire process from start to finish takes about 3 minutes. BBVA does not use ChexSystems but instead utilizes EWS to screen new applicants.

For anyone interested, I signed up for a BBVA Bank checking account. I have been using the new checking account, debit card, online website, direct deposit, and customer service for over a month now. I have to say I am genuinely impressed with everything they have done with me and my account.

So far it seems like the ideal bank.

B. Lewis, BBVA Customer

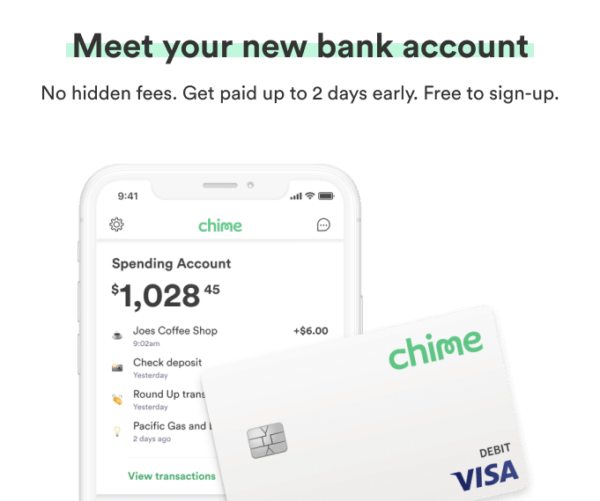

Chime Bank is a fast-growing internet-only bank. Unlike big banks, Chime was created during the smartphone era and, therefore, features an app that is more than just a way for customers to review their bank accounts.And, best of all, Chime Bank accepts all customers who apply. Even if you have bad or poor credit or have been blacklisted by ChexSystems or credit bureaus.

Features include mobile deposits, direct deposit, online bill payment, NO monthly or annual fees, NO overdrafts, NO credit check, and NO CheckSystems.

Here are a few of the highlights:

What Bank Has Free Checking Accounts

- FREE Visa® debit card

- NO monthly service charge

- NO monthly minimums

- NO credit check; Bad credit OK

- NO ChexSystems or Telecheck; guaranteed approval

- FREE online banking and mobile banking/deposits

- FREE mobile and online bill pay

- NO foreign transaction fees

- NO fees at over 38,000 MoneyPass® and Visa Plus Alliance ATMs worldwide

- SAVINGS: You can round up every purchase to the nearest dollar and automatically deposit that difference into your savings account.

Chime Bank Lets You Get A Jump On Payday

You can receive your paycheck up to two days earlier than at a traditional bank if you set up direct deposit — Chime processes your employer’s check immediately instead of waiting like other banks may.

Free Checking Account No Credit Check No Deposit Bonuses

Chime Bank is one of the most friendly banks for those who have been negatively impacted by bad credit, ChexSystems, or Telecheck.

The SoFi Money Cash Management Account is offered by SoFi Securities LLC, a FINRA registered broker dealer. It’s a checking account on steroids and we love that. Plus, they don’t use ChexSystems to approve accounts. You get a debit MasterCard and a very slick smartphone app. You can make deposits, write checks, utilize electronic bill pay and transfer money. There are no monthly fees or overdraft fees. Plus, you earn interest on all the money in the account! The sign up process can take less than 60 seconds. There is no minimum balance requirement and you don’t have to make an initial deposit to get an account. Plus, you can earn a $50 cash bonus if you sign up for SoFi Money® and make one direct deposit of at least $500. Available in all 50 states.

- No account fees

- Unlimited reimbursed ATM fees

- Access to SoFi member benefits like career coaching and financial advising

- Automated bill pay

- Freeze debit card on-the-go

Want A Local Bank or Credit Union? Here’s The List of Best Second Chance Banks and Credit Unions in Every State.

Unfortunately, most major banks don’t offer second chance checking. However, many community banks and credit unions have them under various names, such as Opportunity Checking and Fresh Start Checking.

Some banks and credit unions offer so-called second chance checking accounts to help people rebuild their credit and financial histories. These accounts usually carry monthly fees and come with a few other requirements, such as participating in a financial literacy or money management class. An account holder might also not be eligible for overdraft protection, since second chance banking serves as a way to prevent overdrawing an account altogether.

| STATE BY STATE | |

| Alabama | Alaska |

| Arizona | Arkansas |

| California | Colorado |

| Connecticut | Delaware |

| District of Columbia | Florida |

| Georgia | Hawaii |

| Idaho | Illinois |

| Indiana | Iowa |

| Kansas | Kentucky |

| Louisiana | Maine |

| Maryland | Massachusetts |

| Michigan | Minnesota |

| Mississippi | Missouri |

| Montana | Nebraska |

| Nevada | New Hampshire |

| New Jersey | New Mexico |

| New York | North Carolina |

| North Dakota | Ohio |

| Oklahoma | Oregon |

| Pennsylvania | Rhode Island |

| South Carolina | South Dakota |

| Tennessee | Texas |

| Utah | Vermont |

| Virginia | Washington |

| West Virginia | Wisconsin |

| Wyoming | |

A Few Additional Banks To Consider

Best-in-Class Mobile App

- -NO initial deposit

- -NO overdraft fees

- -NO minimums

- -NO transfer fees

Most Local Branches

- -Mobile check deposit

- -24/7 fraud monitoring

- -Online bill pay

- -Visa debit card

Easy Checking Free with eStatements and 30,000 ATMs

Let’s save you money and make your life easier, starting with Easy Checking, Free with...

All San Diegans are welcome at Mission Federal Credit Union, where your success is our bottom line. That means when you open an account, you’ll start to experience the Mission Fed difference: our special way of offering you the services you need to help you...

Checking and Savings Accounts

If you’re looking for a better place to set up a bank account, make your move to Mission Fed.

If you’re looking for a better place to set up a bank account, make your move to Mission Fed. We’re not only the largest, locally based financial institution exclusively serving San Diego County, we also offer a variety of personal accounts, from Checking...

Courtesy Pay Services

With Mission Debit Card Privilege, Mission Fed may authorize your PIN and signature-based Debit...

With Mission Debit Card Privilege, Mission Fed may authorize your PIN and signature-based Debit Card purchase transactions, even if there is not enough money in your Checking Account to cover them.

Savings Accounts

Find the right Savings Account for you at with Mission Fed.

Free Checking Account No Credit Check No Deposit

Whether you’re looking to save for a 'rainy day,' holiday expenses, your child’s future, or any other special occasion, a Mission Fed Savings Account with online access can help you reach your financial goals.